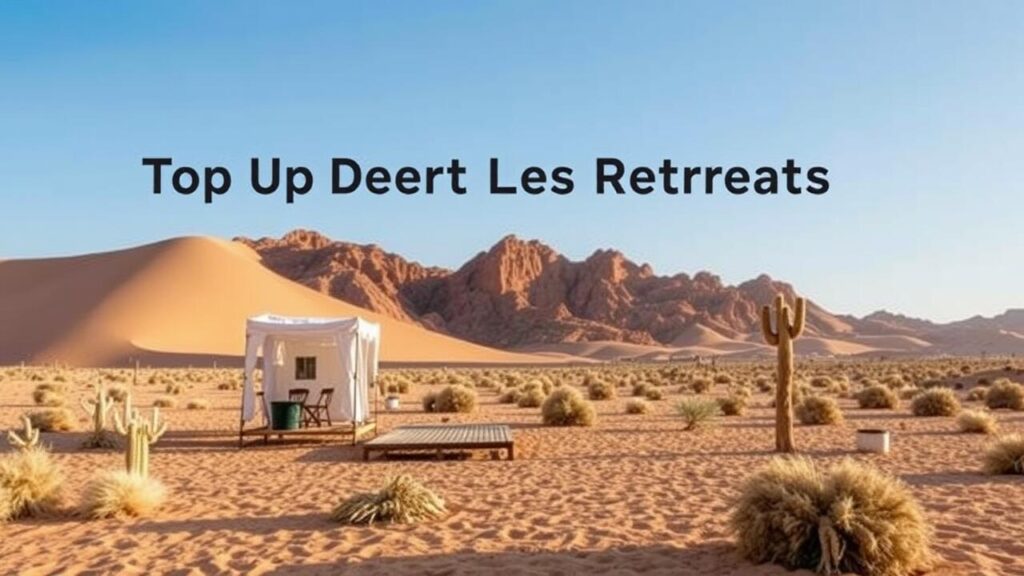

Vacation Rental Borrego Springs: Find Your Perfect Desert Getaway

Choosing the right vacation rental in Borrego Springs requires careful consideration of various factors to ensure a fulfilling experience in this stunning desert landscape. Vacation rentals in this area range from luxurious estates to charming cottages, each offering unique amenities that cater to different preferences. Proximity to the Anza-Borrego Desert State Park is a significant …

Vacation Rental Borrego Springs: Find Your Perfect Desert Getaway Read More »